Skip the Paperwork Marathon: Apply to 15+

Lenders With a Single Click!

Empower your journey with our Education Loans - Get expert guidance, low-interest rates and a hassle-free process.

4.5+ Ratings

4.5+ Ratings

12,000+

students successfully funded

15+

trusted lending partners

From Application to Approval - Your Roadmap to Success

A step-by-step guide to how we help you get the best education loan for studying abroad.

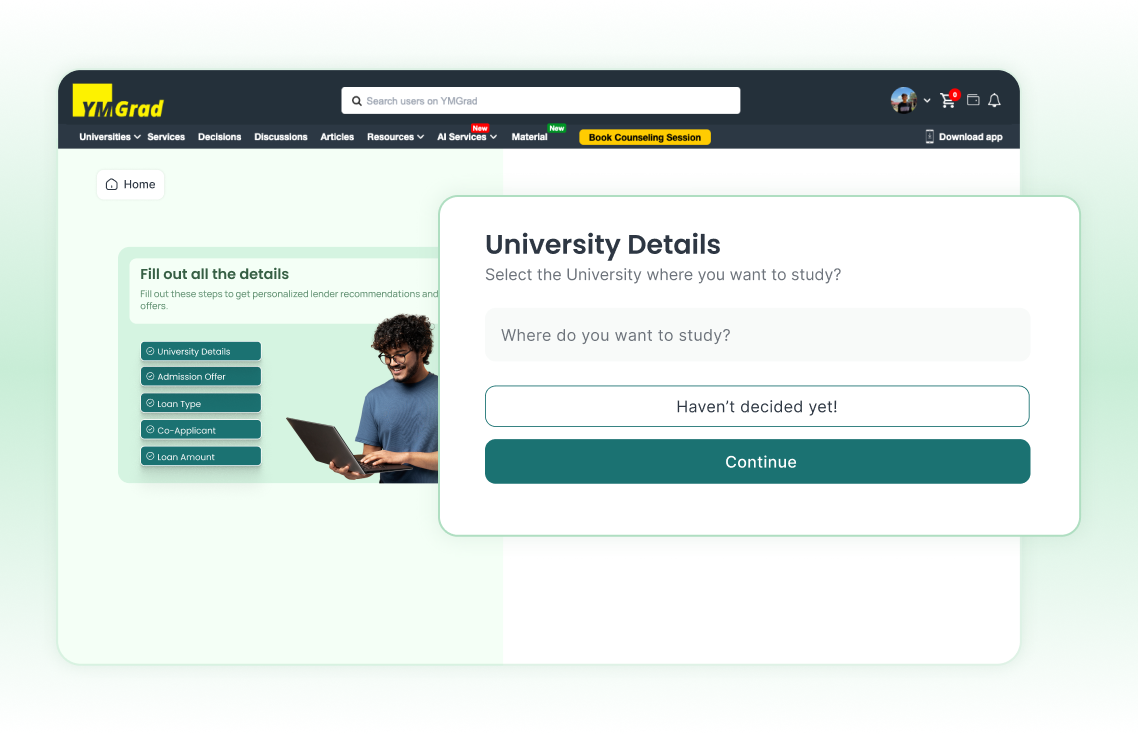

Kickstart Your Journey

Answer 5 quick questions to get tailored loan recommendations.

Connect with a Counselor

Get expert guidance to compare, apply, and secure your loan with ease.

Get Personalized Lender Choices

Get matched with trusted lenders, curated by our professionals.

Mark the milestone

Your study abroad education loan is here!

Discover Funding Options, and Begin Your Journey with Ease

*Actual loan terms may vary based on individual profile and lender assessment.

| PSB | Private Banks | NBFCs | International Lenders | |

|---|---|---|---|---|

| Maximum Loan amount | Up to ₹2 Crore | Up to ₹2 Crore | Up to ₹1.5 Crore | Up to $200,000 |

| Interest Rate | 9.25% – 11.30% | 9.50% – 13.50% | 10% – 14% | 10.5% – 14% |

| Collateral Required* | No (Up to 50 Lakh) | No (Up to 1 Crore) | No (Up to 75 Lakh) | No |

| Repayment Tenure | 15 years | 15 years | 15 years | 15 years |

| Processing Fee | ₹10,000 | 0.50% – 1% | 1% – 2% | 1% – 5% |

Our Partners

Explore our curated network of trusted global lenders.

PSB

PSBMaximum Loan

Up to ₹3 Cr

Interest Rate

9.15% - 10.15%

Processing time

15 - 20 Days

Processing fee

₹10,000

Loan Type

Collateral & Non - Collateral

PSB

PSBMaximum Loan

Up to ₹1.5 Cr

Interest Rate

9.0% - 11.3%

Processing time

7 - 10 Days

Processing fee

Up to ₹20,000

Loan Type

Collateral & Non - Collateral

Private Bank

Private BankMaximum Loan

Up to ₹2 Cr

Interest Rate

9.5% - 13.5%

Processing time

5 - 10 Days

Processing fee

Up to 1%

Loan Type

Collateral & Non - Collateral

Private Bank

Private BankMaximum Loan

Up to ₹3 Cr

Interest Rate

9.5% - 12.5%

Processing time

5 - 10 Days

Processing fee

0.5% - 1%

Loan Type

Collateral & Non - Collateral

Private Bank

Private BankMaximum Loan

Up to ₹1.5 Cr

Interest Rate

9.75% - 11.15%

Processing time

5 - 10 Days

Processing fee

0.75% - 2%

Loan Type

Collateral & Non - Collateral

NBFC

NBFCMaximum Loan

Up to ₹1.25 Cr

Interest Rate

10.25% - 14.5%

Processing time

5 - 7 Days

Processing fee

0.5% - 1%

Loan Type

Collateral & Non - Collateral

NBFC

NBFCMaximum Loan

Up to ₹1 Cr

Interest Rate

11.5% - 13.5%

Processing time

5 - 7 Days

Processing fee

1% - 2%

Loan Type

Collateral & Non - Collateral

NBFC

NBFCMaximum Loan

Up to ₹2 Cr

Interest Rate

9.95% - 11%

Processing time

5 - 7 Days

Processing fee

0.1% - 1%

Loan Type

Collateral & Non - Collateral

NBFC

NBFCMaximum Loan

Up to ₹1.25 Cr

Interest Rate

11.25% - 13.5%

Processing time

5 - 7 Days

Processing fee

0.75% - 1.25%

Loan Type

Collateral & Non - Collateral

International Lender

International LenderMaximum Loan

Up to $100,000

Interest Rate

12.99% - 14%

Processing time

3 - 7 Days

Processing fee

5%

Loan Type

Non - Collateral

International Lender

International LenderMaximum Loan

Up to $220,000

Interest Rate

10.5% - 14%

Processing time

5 - 7 Days

Processing fee

Up to 5%

Loan Type

Non - Collateral

PSB

PSBMaximum Loan

Up to ₹1.5 Cr

Interest Rate

9.70% - 11.15%

Processing time

15 - 20 Days

Processing fee

₹10,000

Loan Type

Collateral & Non - Collateral

NBFC

NBFCMaximum Loan

Up to ₹2 Cr

Interest Rate

10.75% - 13.5%

Processing time

7 - 10 Days

Processing fee

Up to 2%

Loan Type

Collateral & Non - Collateral

Private Bank

Private BankMaximum Loan

Up to ₹2 Cr

Interest Rate

10.5% - 13.5%

Processing time

7 - 10 Days

Processing fee

1% - 2%

Loan Type

Collateral & Non - Collateral

International Lender

International LenderMaximum Loan

Up to $100,000

Interest Rate

11.5% - 14%

Processing time

3 - 5 Days

Processing fee

1% - 3%

Loan Type

Non - Collateral

PSB

PSBMaximum Loan

Up to ₹1 Cr

Interest Rate

9.25% - 11.25%

Processing time

10 - 15 Days

Processing fee

1%

Loan Type

Collateral & Non - Collateral

Why choose YMGrad?

At our core, we prioritize financial inclusivity by offering unbiased guidance so every student can get access to world-class education.

We Advocate for You: We work for you, not the banks, helping you choose from lenders that truly fit your background and goals.

Smart Interest Rates: Access exclusive student offers and negotiated rates that you won’t find on public lender pages.

Transparent Process: From start to finish, we make it easy, with no consultation fees, no jargon, just straightforward guidance.

Real Stories, Real Experiences!

Firsthand experiences from students who turned their study abroad dreams into reality with our Education Loans.

Mohit Kumar

MS in USA

Applying for an education loan felt very difficult, but YMGrad made it effortless. Thank you so muchh folks!

Aditya Rao

MBA from UK

I was really impressed by the recommendations that the counsellor gave me. He didn’t just suggest banks randomly but carefully matched lenders based on my financial profile and study plans.

Ananya Patel

Bachelors in Architecture

They explained every step clearly, handled the paperwork, and secured me a collateral-free loan. The biggest plus point was that I didn’t have to chase banks. Truly thankful for the support and guidance.

Jaspreet Singh

Parent

My counsellor actually compared lenders and negotiated a lower rate than what the banks were offering initially. Saved me time and money!

Rohan Gaur

Bachelors in USA

The team helped me compare lenders and also negotiated a lower rate than I was offered. Saved me time and money!

Priya Malhotra

Masters in USA

I thought getting an overseas loan would be complicated, but it turned out surprisingly easy. The team guided me from day one, checked my eligibility, and even helped me with the documentation. I didn’t have to run around banks.

Mohit Kumar

MS in USA

Applying for an education loan felt very difficult, but YMGrad made it effortless. Thank you so muchh folks!

Aditya Rao

MBA from UK

I was really impressed by the recommendations that the counsellor gave me. He didn’t just suggest banks randomly but carefully matched lenders based on my financial profile and study plans.

Invest in your future without straining you present.

Navigate your application with ease, and unleash the benefits awaiting you.

Frequently Asked Questions!

When you apply on your own, you must approach each lender individually, repeating the same process with multiple banks and financial institutions. With YMGrad, a single application is shared with all suitable lenders simultaneously, saving you significant time and effort. Our team actively negotiates on your behalf to secure the most competitive offer. Because we are partnered with leading lenders, you receive better terms and faster approvals than you would when applying directly.

NO, YMGrad’s education loan assistance is completely free. There are no consultation fees or hidden charges from our side.

NO, your credit score will not be impacted. We only share your profile with lenders who use soft checks or internal eligibility assessments that do not affect your credit report. You can safely explore multiple loan options without worrying about any negative effect on your credit score.

To secure the best loan offer, simply upload the required identity, academic, financial, and co-applicant documents. These help us verify your profile and match you with the most suitable lender. Our expert counselor will also guide you on the exact documents needed to maximize your chances of approval.

Your co-applicant can be any immediate family member or blood relative who has been filing ITR (Income Tax Returns) for at least 2 years. This includes parents, siblings, uncles, aunts, cousins, or in-laws. The exact eligibility criteria can vary from one lender to another, but your YMGrad advisor will help you find the right lender based on your co-applicant’s profile.

Yes, you can. Many lenders assess your overall financial profile and repayment potential rather than focusing only on academics or gap years. Our advisors will guide you toward lenders who are flexible and more likely to approve your profile.

For immediate assistance, please click the WhatsApp icon located at the bottom-left corner of our page. You will be redirected to WhatsApp, where you can share your name and query.